3.4.1Management Board Remuneration Policy

The Supervisory Board aims at remunerating members of the Management Board for long-term value creation. For this purpose a remuneration policy is in place that contributes to a competitive, flexible and predictably aligned remuneration with the (long-term) performance of SBM Offshore. The current version of the remuneration policy (called RP20151) has been effective as per January 1, 2015, after approval by the Annual General Meeting.

In order to support the Supervisory Board in their responsibilities an Appointment and Remuneration Committee (hereafter A&RC) is in place. The A&RC advises the Supervisory Board regarding remuneration matters and makes proposals within the framework of the remuneration policy. The Remuneration Policy 2015 aims at driving the right behavior and consists of four components: (1) Base Salary, (2) Short-Term Incentive, (3) Long-Term Incentive and (4) Pension and benefits. These components are explained hereafter.

1. Base salary

The Supervisory Board wants base salary levels for Management Board members to reflect the extent of their day-to-day responsibilities and to reward them in their effort in fulfilling these responsibilities.

In order to determine a competitive base salary level, the Supervisory Board compares base salary levels of the Management Board with relevant companies in the industry but has also indicated that SBM Offshore does not want to be part of the 25% highest rewarding companies on base salary in the relevant market. The Supervisory Board uses the reference group of relevant companies in the industry (hereafter the Pay Peer Group) to determine base salary levels and to monitor total remuneration levels of the Management Board. Base salaries of the Management Board members and the Pay Peer Group are reviewed annually.

Pay Peer Group

The Pay Peer Group consists of a group of companies that reflect the competitive environment for executive talent in which SBM Offshore operates. The companies in the Pay Peer Group are comparable to SBM Offshore in size (revenue and market capitalization), industry (global oil and gas services companies) and in terms of complexity, data transparency and geography. The Pay Peer Group may be changed by the Supervisory Board to reflect a change in the business or strategy. Any changes deemed to have a material impact on remuneration levels will be submitted to the Annual General Meeting for approval. In 2017, the Supervisory Board concluded that no new additions to the Pay Peer Group were needed for 2017 and a more extensive review of the pay peer group was already in progress as part of the development of RP2018. 50% of the Peer Group companies are listed in the U.S. since a dominant part of the offshore oil and gas services market is concentrated in the U.S.

Current Pay Peer Group

|

|

|

|

|

|

|

|

|

|

2. Short-Term Incentive

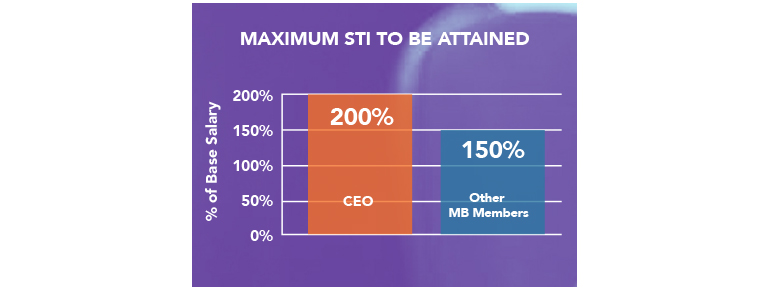

The Supervisory Board uses the Short-Term Incentive (STI) to reward the Management Board for delivering the Company’s short-term objectives, as derived from the long-term strategy, for a specific year. The following graph shows the maximum STI value that can be attained.

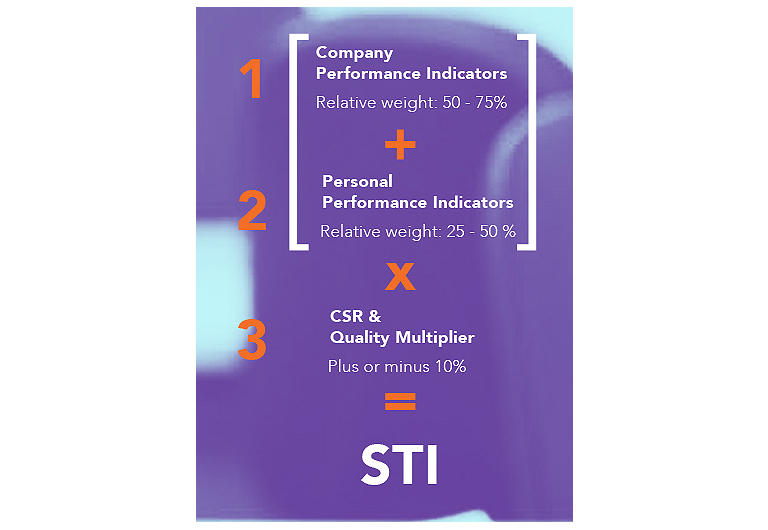

In order to reach these maximum values, the Management Board must achieve multiple objectives as displayed in the following figure :

The Company Performance Indicators (1) and Personal Performance Indicators (2) together have a relative weight of 100%. The Corporate Social Responsibility & Quality Multiplier can cause a 10% in- or decrease of the total STI value based on safety and quality performance in combination with SBM Offshore’s Dow Jones Sustainability Index score. In case 100% of the Company and Individual Performance Indicators have been realized, the multiplier will not provide any additional uplift.

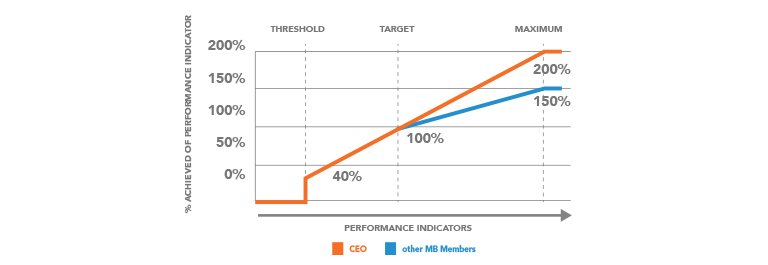

At the beginning of each year, the Supervisory Board, at the recommendation of the A&RC, sets the performance indicators and their respective weighting. The chosen performance indicators are based on the Company’s operating plan. For each Performance Indicator a scenario analysis is performed to determine a threshold, target and maximum level considering market and investor expectations as well as the economic environment. The graph hereafter displays the actual range application for Performance Indicators.

Achievement range for Performance Indicators

The details around selected Performance Indicators and their weightings are regarded commercially sensitive and therefore not suitable for predisclosure. However, SBM Offshore does disclose the selected Performance Indicators applied over the previous year in the Remuneration Report at the end of each performance year. As such, the Performance Indicators applicable in 2017 are mentioned in section 3.4.2 of this report.

At the end of the year, the A&RC reviews the performance of the Management Board members compared on the chosen Performance Indicators and makes a recommendation to the Supervisory Board to determine the STI pay-out level. The STI is payable in cash after the publication of the annual financial results for the performance year.

3. Long-Term Incentive

The Supervisory Board regards the Long-Term Incentive (LTI) both as a retention instrument and as a reward to the Management Board for delivering the Company’s long-term objectives over a three year period, as derived from the Company’s strategy.

The maximum LTI value is determined by the number of shares that can be attained by the Management Board. Each year, on a conditional basis, shares of Company stock (so-called restricted share units) are granted to Management Board members. A share pool of 1% of the Company’s share capital (as of year-end prior to the performance period) is available for share based awards for all staff including the Management Board. The Supervisory Board, upon recommendation of the A&RC, determines the proportion of the share pool that shall be available to the Management Board. The current proportion is 20% of which 40% is reserved for the CEO and 20% for each other Management Board Member. The graph hereafter shows the maximum LTI value that can be attained.

In order to reach these maximum values, the Management Board needs to achieve multiple objectives as are displayed in the following figure.

At the beginning of each year, the Supervisory Board, at the recommendation of the A&RC, chooses one or more of the three performance indicators and determines their respective weighting. For each performance indicator a scenario analysis is performed to determine threshold, target and maximum levels considering market and investor expectations as well as the economic environment.

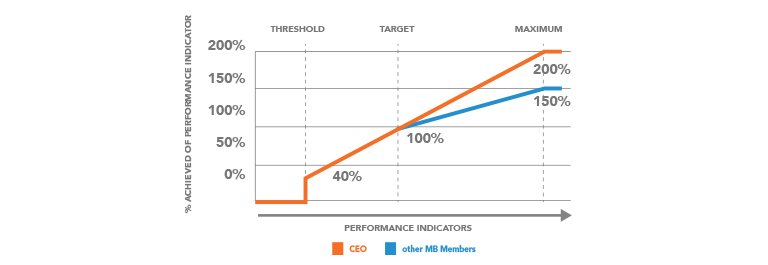

The following graph displays the actual range application for the performance indicators. This process (i.e. the linear approach between threshold, target and maximum) is equal to the STI approach.

Achievement Range for LTI Performance Indicators

After the end of each year, the Supervisory Board, at recommendation of the A&RC, assesses the extent to which the chosen LTI Performance Indicators have been met which determines the number of shares that will vest. These shares vest after the Annual General Meeting.

The vested LTI shares are restricted for an additional two years following the vesting date with the exception of those shares that are sold to pay taxes levied on the value of the vested LTI shares.

4. Pension

The Management Board members are responsible for their own pension arrangements. In order to facilitate this, they receive a pension allowance equal to 25% of their Base Salary. A similar approach also applies to employees working in the headquarters in the Netherlands. SBM Offshore has chosen not to offer a (global) companywide pension scheme to its employees due to the strong international character of the Company and the fact that pensions are highly regulated by local legislation.

Other key elements of the Management Board remuneration and employment agreements

Adjustment of remuneration and clawback

The service contracts of the Management Board members contain an adjustment clause giving discretionary authority to the Supervisory Board to adjust upwards or downwards the payment of any variable remuneration component that has been conditionally awarded, if a lack of adjustment would produce an unfair or unintended result as a consequence of extraordinary circumstances during the period in which the performance criteria have been or should have been achieved. In addition, a claw-back provision is included in the service contracts enabling the Company to recover variable remuneration components on account of incorrect financial data. The provisions of the Dutch regulations on the revision and claw-back of variable remuneration and its provisions related to change of control arrangements apply. Under the claw-back provisions, STI and LTI awards can be clawed back at the discretion of the Supervisory Board, upon recommendation of the A&RC in the event of a misstatement of the results of the Company or an error in determining the extent to which performance indicators were met.

Severance Arrangements

The Supervisory Board, upon recommendation of the A&RC will determine the appropriate severance payment. This will not exceed a sum equivalent to one times annual base salary, or if this is manifestly unreasonable in the case of dismissal during the first appointment term, two times the annual base salary. For each Management Board member, the appropriate level of severance payment is assessed in relation to remuneration entitlements in previous roles. As a result, the severance payment in case of termination is set within the boundaries of the Dutch Corporate Governance Code.

In the case of early retirement, end of contract, disability or death, any unvested LTI shares vest pro-rata, with discretion for the Supervisory Board, to increase or decrease the final number of LTI shares vesting up to the maximum opportunity. In the case of resignation or dismissal, any unvested LTI shares will be forfeited unless the Supervisory Board determines otherwise.

Share Ownership Requirement

Each Management Board member must build-up a specific percentage of base salary in share value in SBM Offshore. For the CEO this level is set at an equivalent of 300% of base salary and for the other Management Board members, the level is set at 200%. The Management Board must retain vested shares in order to acquire the determined shareholding level. An exception is made in case Management Board members wish to sell shares to satisfy tax obligations in relation to LTI shares. Unvested shares do not count towards the requirement.

Loans

SBM Offshore does not provide loans or advances to Management Board members and does not issue guarantees to the benefit of Management Board members.

Expenses and Allowances

The Management Board members are entitled to a defined set of emoluments and benefits. A general benefit in this area is the provision of a company car allowance. Other benefits depend on the personal situation of the relevant Management Board members and may include medical and life insurance and a housing allowance.