3.6Shareholder Information

Listing

SBM Offshore has been listed on the Amsterdam Euronext since 1965. The market capitalization as at year-end 2017 was US$ 3.6 billion. The majority of the Company’s shareholders are institutional long-term investors.

Financial Disclosures

SBM Offshore publishes audited full-year earnings results and unaudited half-year earnings results, which include financials, within sixty days after the close of the reporting period. For the first and third quarters, SBM Offshore publishes a trading update, which includes important Company news and financial highlights. The Company conducts a conference call and webcast for all earnings releases and a conference call only for all trading updates during which the Management team presents the results and answers questions. All earnings-related information, including press releases, presentations and conference call details are available on our website. Please see the Financial Calendar of 2018 at the end of this section for details of the timing of publication of financial disclosures for the remainder of 2018.

In 2017, the Company expanded its ‘Directional’ reporting. In addition to the Directional income statement, reported since 2013, a Directional balance sheet and cash flow statement are also disclosed in the section 4.3.2 Operating segments and Directional reporting of the Consolidated Financial Statements. Expanding Directional reporting aims to increase transparency in relation to SBM Offshore’s cash flow generating capacity and to facilitate investor and analyst review and financial modeling. Furthermore it also reflects how management monitors and assesses financial performance of the Company. Directional reporting is reported as an integral component of the Company audited Consolidated Financial Statements under the section 4.3.2 Operating segments and Directional reporting. As such, Directional accounts are audited by the Company’s external auditor.

Dividend Policy

The Company’s policy is to maintain a stable dividend, which grows over time. Determination of the dividend is based on the Company’s assessment of the underlying cash flow position and of ‘Directional net income’, where a target payout ratio of between 25% and 35% of ‘Directional net income’ will also be considered.

On May 12, 2017, SBM Offshore paid a cash dividend of US$ 0.23 or EUR 0.2159 per share in relation to the 2016 results, in line with c. 30% of underlying Directional net income, after adjustment for non-recurring exceptional items concerning compliance-related settlements.

In line with the Company’s dividend policy and further taking into account the specific circumstances relating to 2017 including the nature of the non-recurring items, the Company proposes a dividend of US$ 0.25 per share in respect of 2017, to be declared at the AGM on April 11, 2018. This represents a circa 9% increase per share compared to last year and represents a pay-out of circa 64% of underlying Directional 2017 net result, which was adjusted for exceptional items. The proposed ex-dividend date is April 13, 2018. The dividend is payable within 30 days following the AGM and will be calculated in US Dollars but payable in Euros. The conversion into Euros will be effected on the basis of the exchange rate on April 11, 2018. Given the Company’s cash position, the dividend will be fully paid in cash.

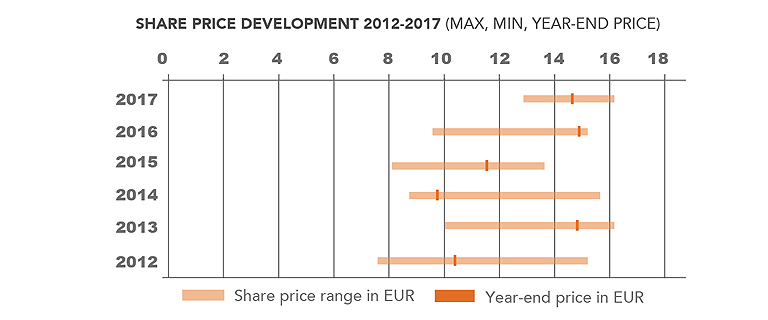

Share price development in 2017

|

Year-end price |

EUR 14.67 |

December 31, 2017 |

|

Highest closing price |

EUR 16.04 |

April 7, 2017 |

|

Lowest closing price |

EUR 13.105 |

August 29, 2017 |

For 2017 the relevant press releases covering the key news items are listed below:

|

|

|

|---|---|

|

08-02-17 |

2017 Full Year Earnings |

|

13-04-17 |

Annual General Meeting 2017 Publications |

|

10-05-17 |

First Quarter Trading Update |

|

22-06-17 |

Awarded Turnkey and Lease and Operate Contracts for the ExxonMobil Liza FPSO |

|

11-07-17 |

Turritella (FPSO) Purchase Option Exercised by Shell |

|

17-07-17 |

Agreed Heads of Terms for Settlement with a Majority Group of Primary Layer Insurers on Its Yme Insurance Claim |

|

09-08-17 |

2017 Half-Year Earnings |

|

11-08-17 |

Confirmed Settlement with Extended Group of Insurers on its Yme Insurance Claim |

|

06-11-17 |

Update on Legacy Issues |

|

08-11-17 |

Third Quarter Trading Update |

|

30-11-17 |

Resolution with the U.S. Department of Justice |

|

06-12-17 |

Awarded Turnkey Contracts for Statoil’s Johan Castberg Turret Mooring System |

|

20-12-17 |

Completion of US$ 720 Million Financing of Liza FPSO |

|

22-12-17 |

Update on Legacy Issue in Brazil |

Major SHAREHOLDERS

As at December 31, 2017 the following investors holding ordinary shares had notified an interest of 3% or more of the Company’s issued share capital to the Autoriteit Financiële Markten (AFM) (only notifications after July 1, 2013 are included):

|

Date |

Investor |

% of share capital |

|---|---|---|

|

18 December 2017 |

FIL Limited |

4.99% |

|

6 November 2017 |

JO Hambro Capital Management Limited |

5.75% |

|

21 June 2017 |

Invesco Limited |

3.12% |

|

9 November 2015 |

Dimensional Fund |

3.18% |

|

18 November 2014 |

HAL Trust |

15.01% |

|

13 November 2014 |

Templeton Funds |

3.30% |

Investor Relations

The Company maintains open and active engagement with its shareholders and aims to provide information to the market which is consistent, accurate and timely. Information is provided among other means through press releases, presentations, conference calls, investor conferences, meetings with investors and research analysts and the Company website. The website provides a constantly updated source of information about our core activities and latest developments. Press releases and presentations can be found there under the Investor Relations Center section.

Financial Calendar

|

|

|

|

|---|---|---|

|

Annual General Meeting of Shareholders |

11 April |

2018 |

|

Trading Update 1Q 2018 – Press Release |

9 May |

2018 |

|

Half-Year 2018 Earnings – Press Release |

9 August |

2018 |

|

Trading Update 3Q 2018 – Press Release |

15 November |

2018 |